road tax rate malaysia

Claims for capital allowance can be made in the relevant column provided in the Tax Return Form. This means you cant drive or park your car on a public road and it must be kept in a garage or on private land.

How Much Do You Know About Malaysian Road Tax Ezauto My

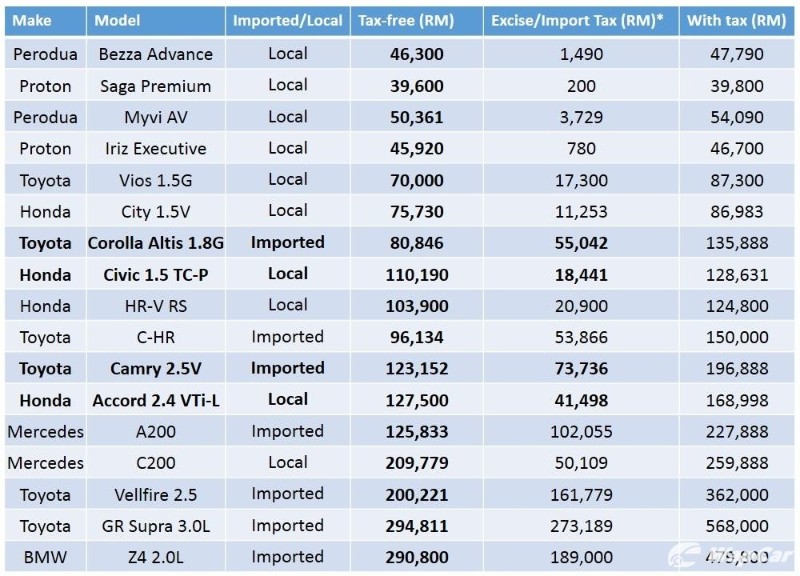

On-the-road price includes on top of the cost of the motorcycle other charges such as vehicle registration fee road tax insurance premium legal stamp duty and handling fees for financing etc.

. Vehicle and vessel tax - a tax levied at a fixed amount annually on the owners of vehicles and vessels used in the China. Be sure to retain your original travel documents ie. Kennesaw Mayor Derek Easterling broke a tie to kill a proposed cut to the tax rate at Mondays council meeting.

Malaysia Electric Vehicle Market size was valued at USD 1382 Mn. According to Section 831 of the ITA a tax is imposed on every non-resident person who derives any dividend interest royalty rent natural resource payment or management charge from sources in Uganda. The same definition applies to other time periods.

The effective rate is the total tax paid divided by the total amount the tax is paid on while the marginal rate is the rate paid on the next dollar of income earned. Raising the Profile of MAICSA. Your total interest interest rate100 x loan amount x loan period.

For example if income is taxed on a formula of 5 from 0 up to 50000 10 from 50000 to 100000 and 15 over 100000 a taxpayer with income of 175000 would pay a total. Records show that no expatriate workers in the country failed to pay taxes imposed on them says Immigration Department director-general. Aug 17 2022 Aug 17 2022.

These are the formulas used to determine the total interest monthly interest and monthly installment for your loan. Old Klang Road 58000 Kuala Lumpur Phone. The main national road network is the Malaysian Federal Roads System which span over 49935 km 31028 mi.

The time period 0730-0800 means the corresponding ERP rate applies from and including 730am and applies until but excluding 800am. In 2020 and the total revenue is expected to grow at 1246 through 2021 to 2027. You have full access to this recording rental until March 1 2023.

Despite the fact that the NAP made no mention of EV incentives or tax advantages MITI deputy minister Ong Kian. Personal Tax Reliefs 2020 Malaysia. The current no new revenue rate is 3411 cents per 100 taxable value.

603 2704 4886 Email. Persatuan Insurans Am Malaysia 3rd Floor Wisma PIAM 150. Alternatively you may submit the claim via your Enrich account online or you may call the Malaysia Airlines Contact Centre at 1 300 88 3000 within Malaysia and 603 7843 3000 outside Malaysia.

The only time you dont need to tax or insure your car is if you declare it off the road and make a Statutory Off Road Notification SORN. A vehicle can be either private-owned or company-owned. Recognised professional body for Chartered Secretaries and Chartered Governance Professionals in Malaysia.

Dividends are tax free. At Tuesdays commissioners meeting a unanimous vote changed the maximum rate to 3552 cents per 100 of taxable value. ERP rates are adjusted to keep traffic moving at an optimal speed range of 20-30 kmh on arterial roads and 45-65 kmh on expressways.

Rate applied 5 years old. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Holly Springs Police Department.

Most of the federal roads in Malaysia are 2. Malaysia Personal Income Tax Rates 2021 YA 2020 Top 5 Project List. WHT at a rate 15 therefore applies on gross dividend payments interest management fees and royalty payments in respect of non-treaty.

Singapore follows a single-tier corporate tax system where tax paid by a company on its profits is not imputed to the shareholders ie. After that the rate will be 499 per month. Agile Bukit Bintang.

Singapore personal tax rates start at 0 and are capped at 22 above S320000 for residents and. For the smaller companies the rate is 19. Boarding pass and ticket stubs as you will need this in order to complete the Missing Enrich.

This information will be used when you tax your car either online or at a post office. After that date the link will expire the training will no longer be available and you will not be able to receive TMLI credit. The Road leading to Devolution Status.

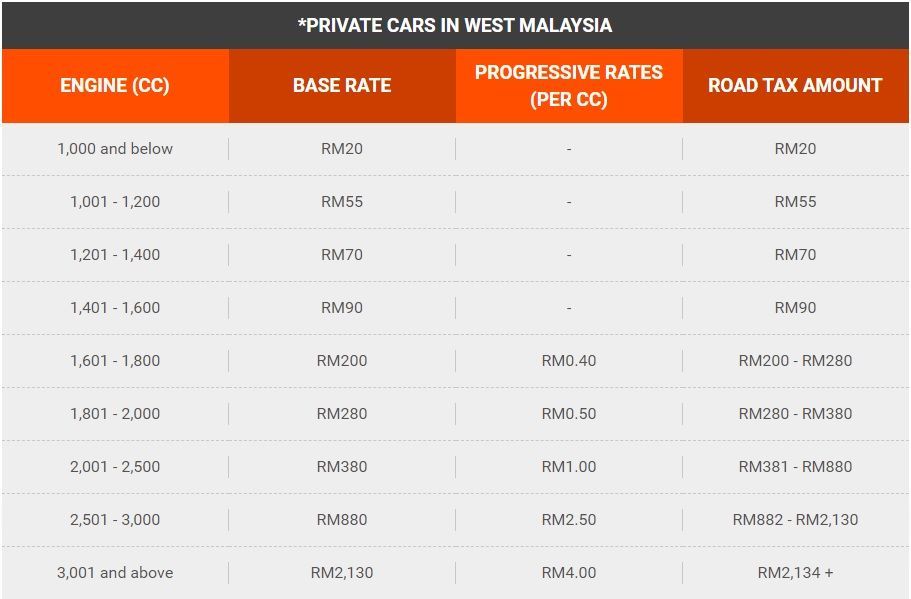

The Next Millennium. The answer is Annual Income deducting Tax Reliefs and then multiplying Individual Income Tax Rate. To calculate the road tax of a vehicle the base rate and progressive rate will have to be combined.

Real estate tax - a tax imposed on the owners users or custodians of houses and buildings at the rate at either 12 of the original value with certain deduction or 12 of the rental value. The installment and interest rate that is calculated for your fixed-rate car loan is determined by these values. To boost demand the government offered EV drivers a 90 road tax reduction.

1981 - 1990. At the same time the proposed tax rate is being reduced over a penny and a half from the FY 2022 adopted rate making the FY 2023 proposed tax rate of 0217543 the lowest it has been since 1986. At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc and below.

In 2016 the Inland Revenue Board of Malaysia lowered the effective tax rate to 24 for businesses with capital exceeding 25 million ringgit. The type of vehicle ownership will also affect the road tax rate. 1991 - 1999.

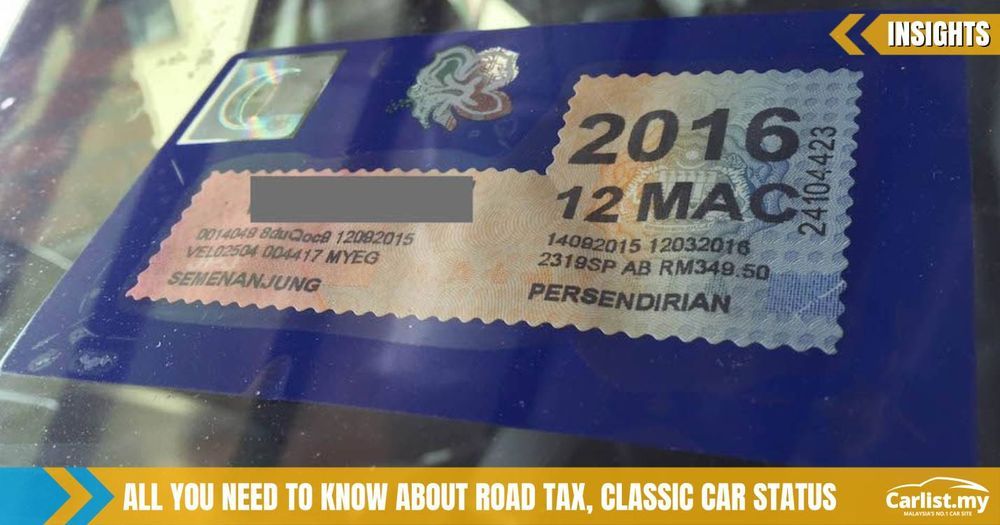

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

Car Road Tax Calculator In Malaysia Wapcar

Car Tax Calculator Calculate Your Car Taxes Car Insurance Cheap Car Insurance Inexpensive Car Insurance

Domestic Renewable Heat Incentive Scheme Rhi In The United Kingdom Incentive Renew Renewable Sources Of Energy

3d Model Of Bentley Continental Gt 2021

The Crux Co Cake Brochure On Behance Brochure Menu Layout Menu Design

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

马来西亚更新汽车路税的费用 Lc 小傢伙綜合網 Financial Advisors Road Tax Advisor

Glamping In Moab Utah Luxury Tent Camping Luxury Tents Moab Utah Utah Luxury

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Pin By Ronald Alfonso Montiel Nieto On Guardado Rapido In 2022 Coilovers Fitness Honda

2 Pack Brake Master Cylinder Replacement Fit For Ford E150 Econoline 132794 Ebay In 2022 Cylinder Ebay Ford

Pin By Humam Zidni On Civic Sb3 1985 Honda Civic Japanese Cars Honda

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Driving The Bufori Geneva Malaysia S Kevlar Bodied Answer To Rolls Royce Rolls Royce Kevlar Car Culture

Road Tax In Malaysia 2022 Calculate Now Policystreet

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

No comments for "road tax rate malaysia"

Post a Comment